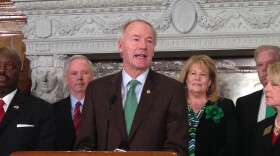

The following is a transcript of Gov. Asa Hutchinson's radio column for the weekend of Dec. 16, 2016:

During my campaign for Governor, one the most important pieces of my platform was my promise to lower our state income tax. Shortly after being sworn in as Governor in January of 2015, I signed into law a $100 million Middle Class Tax Cut, the largest income tax cut in Arkansas history. On Tuesday of this week, I announced my second round of tax cuts—this time a $50 million cut to the state’s income tax rate.

While my first round of tax cuts affected the middle income levels—those making between $21,000 and $75,000 a year—my newest proposal would offer relief for the state’s lower income brackets by focusing on Arkansans who earn below $21,000 annually.

This plan would reduce the burden on an estimated 657,000 working Arkansans, 120,000 of whom would be removed from the tax rolls completely. Of course, this proposal will need the support of the Arkansas General Assembly, but if it’s adopted, a total of 1.3 million Arkansans—or 90% of the state’s individual income taxpayers—will have benefited from substantive tax relief legislation since 2015.

In addition to my proposed $50 million tax cut, I also announced on Tuesday my support for exempting all retirement benefits of retired military service members from state income tax. If passed, Arkansas would join the 16 other states that currently exempt retired military pay. I believe this exclusion is the right thing to do for our veterans and for the Arkansas economy. We want retired service members to consider Arkansas when starting their second career.

It’s important to note that this exemption would result in a $13 million reduction in General Revenue. As Governor, it’s my job to ensure that our tax policy is aligned with the realities and obligations of the state. That means any additional tax reductions—apart from my income tax cut proposal—must be offset with the repeal of certain tax exemptions. This is a responsible and conservative approach to cutting taxes.

Both of these proposals are key economic development initiatives and are important priorities to me as we prepare for the 2017 legislative session. I have no doubt, if passed, these measures will make Arkansas more competitive with our surrounding states and will spur job creation, economic growth and put money back into the pockets of hardworking Arkansans.